Afterpay, a popular "buy now, pay later" (BNPL) service, has significantly altered the retail landscape, particularly among younger consumers. To understand its impact and sustainability, it's crucial to delve into its operational mechanics and revenue generation.

At its core, Afterpay functions as a short-term, interest-free installment loan. When a customer makes a purchase at a retailer that partners with Afterpay, they can choose Afterpay as their payment method at checkout. Afterpay then splits the total purchase price into four equal installments, due every two weeks. The first installment is typically paid at the time of purchase, while the remaining three are automatically debited from the customer's linked bank account or credit card.

The appeal of Afterpay lies in its accessibility and convenience. It eliminates the need for traditional credit checks, making it an attractive option for individuals with limited or no credit history, or those wary of accruing interest charges on credit cards. The deferred payment schedule allows customers to acquire goods immediately without bearing the full financial burden upfront, effectively smoothing out their cash flow. This is particularly appealing for larger purchases or during periods of financial strain.

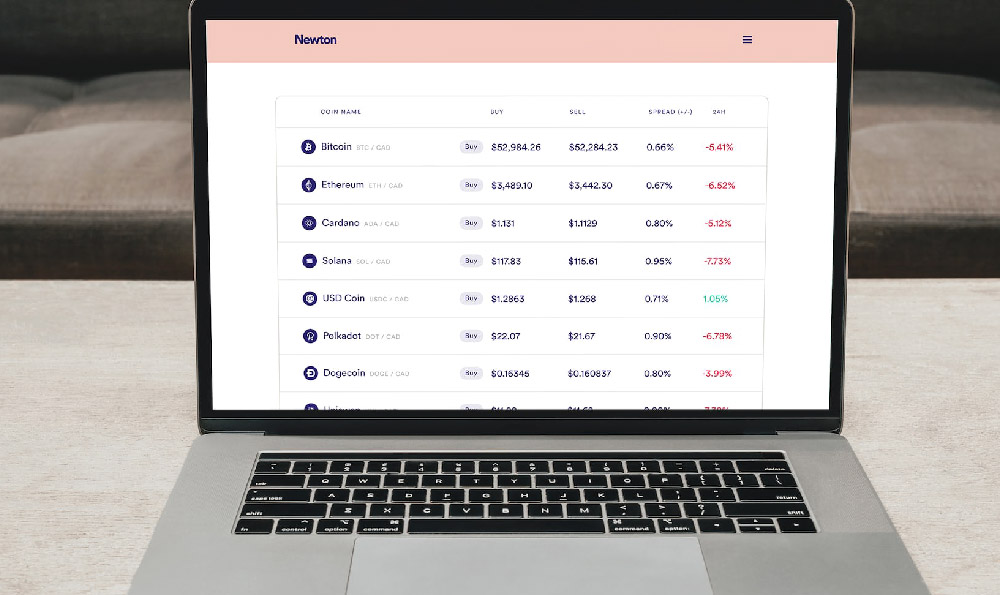

While Afterpay markets itself as interest-free, its revenue model hinges on two primary sources: merchant fees and late payment fees. The bulk of Afterpay's revenue comes from the fees it charges merchants. These fees, typically ranging from 4% to 6% of the transaction value plus a fixed transaction fee, are significantly higher than traditional credit card processing fees. Merchants are willing to pay these higher fees because Afterpay drives incremental sales and increased average order values. By offering a flexible payment option, Afterpay encourages customers to make purchases they might otherwise postpone or forgo altogether. Retailers also benefit from the potential to attract new customers who are specifically drawn to the BNPL service. From the retailer's perspective, Afterpay essentially acts as a marketing tool, customer acquisition engine, and sales booster, justifying the higher transaction costs.

The second revenue stream for Afterpay stems from late payment fees charged to customers who fail to make timely installment payments. While Afterpay publicly emphasizes its commitment to responsible lending and discourages users from overextending themselves, these late fees represent a significant portion of its income, particularly in the early stages of user adoption. Afterpay implements several mechanisms to mitigate the risk of non-payment. It starts by sending reminders before each payment is due, allowing customers to adjust their payment schedules if needed. If a payment fails, Afterpay typically allows a short grace period before charging a late fee. Subsequent failed payments can result in account suspension, preventing the customer from making further purchases using Afterpay until the outstanding balance is settled. The company states it caps late fees to a relatively low amount, usually a fixed dollar amount per missed payment, and limits the total late fees a customer can incur on a single purchase to a percentage of the original purchase price. This approach aims to strike a balance between deterring late payments and maintaining a positive customer relationship.

However, the reliance on late fees has drawn criticism, with some regulators and consumer advocacy groups raising concerns about the potential for debt accumulation and predatory lending practices. Critics argue that the ease of access and the perceived lack of traditional credit scrutiny can encourage impulsive spending and financial overextension, particularly among vulnerable populations. They highlight the risk of consumers taking on multiple BNPL obligations simultaneously, leading to a cycle of debt and late payment fees.

The sustainability of Afterpay's business model is subject to ongoing debate and scrutiny. The competitive landscape of the BNPL sector is rapidly evolving, with established financial institutions and new fintech startups entering the market. This increased competition is likely to put downward pressure on merchant fees, potentially impacting Afterpay's profitability. Furthermore, regulatory oversight of the BNPL industry is increasing, with authorities in various countries examining the potential risks and implementing measures to protect consumers. These regulatory changes could impose additional compliance costs and limitations on Afterpay's operations.

Looking ahead, Afterpay's success hinges on its ability to maintain its appeal to both merchants and consumers while navigating the evolving regulatory environment and intensifying competition. Diversifying its revenue streams beyond merchant fees and late payments, such as offering premium subscription services or partnering with other financial institutions, could enhance its long-term sustainability. Furthermore, investing in robust credit risk assessment tools and promoting responsible spending habits among its users are crucial for mitigating the risks associated with debt accumulation and maintaining a positive brand reputation. The future of Afterpay, and the broader BNPL industry, will depend on its ability to adapt to these challenges and demonstrate its value as a responsible and sustainable alternative to traditional credit options. The company needs to continuously innovate and demonstrate its commitment to ethical lending practices to secure its position in the evolving financial ecosystem.