Penny stocks, also known as microcap stocks, are shares of small public companies that trade for less than $5 per share. They're often associated with higher risk and potential for significant gains, making them attractive to some investors while deterring others. Understanding how to find them and whether they're a good investment requires careful consideration of their nature and the investment strategies involved.

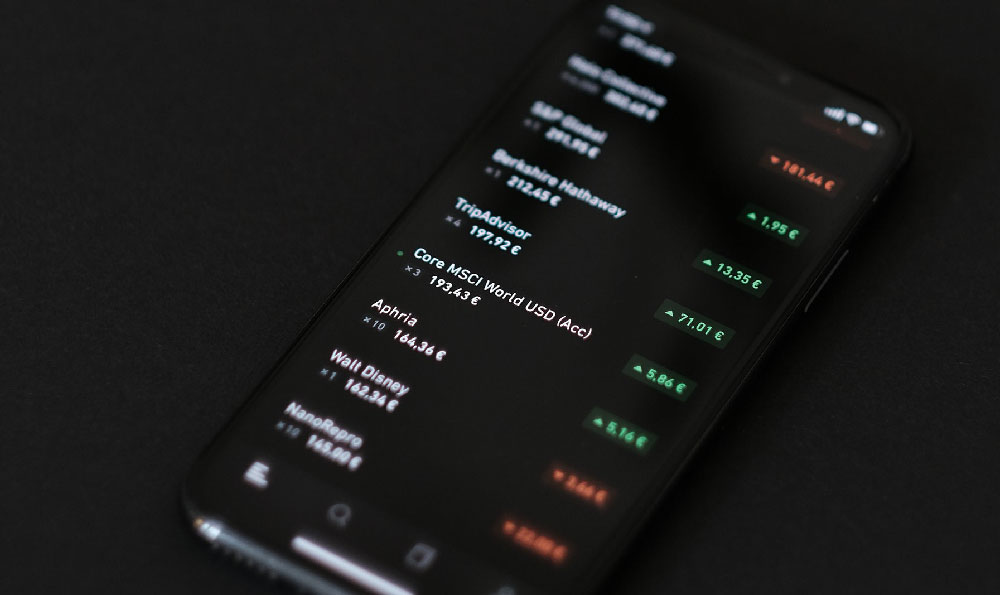

Locating these stocks involves navigating various resources and tools, each with its own strengths and weaknesses. Online brokerage platforms are a common starting point. Many major brokers, such as Fidelity, Schwab, and Interactive Brokers, offer screening tools that allow you to filter stocks based on price, market capitalization, and other criteria. You can set your filters to identify stocks priced below $5. However, it’s important to verify whether the broker provides access to OTC (Over-the-Counter) markets, where many penny stocks are traded. Not all brokers do.

Financial websites like Yahoo Finance, Google Finance, and Finviz are also valuable resources. Finviz, in particular, is known for its comprehensive stock screening capabilities, allowing you to filter by factors like price, volume, sector, and various technical indicators. These sites aggregate market data from various sources, providing real-time information on stock prices, trading volume, and company news. Use these screeners with caution; low price alone shouldn't be the sole determining factor.

Specialized websites and newsletters focusing specifically on penny stocks can also be helpful. These sources often provide in-depth analysis and recommendations on emerging companies. However, it's crucial to exercise caution and due diligence when relying on these sources, as some may have hidden agendas or receive compensation for promoting certain stocks. Reputable financial news outlets may occasionally cover microcap companies, but such coverage is usually limited.

Beyond these resources, SEC (Securities and Exchange Commission) filings provide crucial insight into the financial health and operations of these companies. EDGAR, the SEC's database, allows you to access filings like 10-K (annual reports) and 10-Q (quarterly reports), which contain detailed information about a company's revenue, expenses, assets, and liabilities. This information is vital for understanding the company's fundamentals and assessing its long-term viability.

After identifying potential stocks, evaluating their suitability as investments is paramount. One must delve into financial statements. Carefully examine the company's revenue, profitability, debt levels, and cash flow. Companies with consistent revenue growth, positive earnings, and healthy balance sheets are generally more attractive. Be wary of companies with high debt loads or declining revenue, as these may be signs of financial distress.

Scrutinize the management team. The leadership's experience, track record, and integrity are crucial factors. Research the backgrounds of the CEO, CFO, and other key executives to assess their ability to guide the company successfully. Look for signs of competence, transparency, and a commitment to shareholder value. Beware of companies with management teams that have a history of questionable practices or conflicts of interest.

Analyze the company's business model. Understand the products or services it offers, its target market, and its competitive landscape. Assess the company's ability to innovate, adapt to changing market conditions, and create a sustainable competitive advantage. Look for companies with a clear value proposition and a solid plan for growth.

Evaluate the company's industry. Consider the industry's growth prospects, competitive intensity, and regulatory environment. Look for companies operating in industries with strong growth potential and favorable market dynamics. Be wary of companies operating in industries that are declining or facing significant regulatory challenges.

Understand the risks associated with these stocks. They are inherently volatile and illiquid. Their prices can fluctuate dramatically in a short period, and it may be difficult to buy or sell shares quickly. This volatility is often driven by factors such as speculation, rumors, and manipulation. The lack of liquidity can make it difficult to exit a position at a desired price, especially in times of market stress.

Consider the potential for fraud and scams. The OTC markets are less heavily regulated than major stock exchanges, making them more vulnerable to fraudulent activities. Pump-and-dump schemes, in which promoters artificially inflate the price of a stock and then sell their shares for a profit, are a common occurrence. Be wary of unsolicited investment advice or guarantees of high returns.

Deciding whether penny stocks are "good" investments depends entirely on your individual risk tolerance, investment goals, and time horizon. For risk-averse investors, they are generally unsuitable. The high level of volatility and potential for losses make them a poor fit for those who prioritize capital preservation. On the other hand, for risk-tolerant investors with a long-term investment horizon, they may offer the potential for significant returns. However, it's crucial to recognize that these returns come with a high degree of risk.

A responsible approach involves allocating only a small portion of your portfolio to these stocks, and being prepared to lose your entire investment. Avoid putting all your eggs in one basket, and diversify your investments across different asset classes and sectors.

In conclusion, finding penny stocks requires utilizing various online resources and tools, while determining their suitability as investments requires thorough due diligence, a deep understanding of their associated risks, and a careful consideration of your individual investment profile. They are not inherently "good" or "bad" investments; their suitability depends on your specific circumstances and investment objectives.