Okay, here's an article exploring Elon Musk's revenue streams, focusing on the various avenues he uses to generate wealth:

Elon Musk is a name synonymous with innovation, ambition, and, undeniably, wealth. His entrepreneurial pursuits have disrupted multiple industries, from electric vehicles and space exploration to artificial intelligence and brain-computer interfaces. Understanding how Musk amasses his fortune requires a deep dive into the revenue streams powering his various ventures, which extend far beyond a single salary.

Tesla, arguably the most well-known of Musk's ventures, is a significant contributor to his wealth. The company's revenue is primarily generated from the sale of electric vehicles, encompassing models like the Model S, Model 3, Model X, and Model Y. These vehicles command a premium price point, reflecting the advanced technology, performance, and brand prestige associated with Tesla. Beyond vehicle sales, Tesla also generates revenue from services, including maintenance, repairs, and over-the-air software updates. This recurring revenue stream contributes significantly to the company's overall financial health and stability. Tesla's energy division, which focuses on solar panels, solar roofs, and energy storage solutions like the Powerwall and Megapack, is another important revenue stream. These products cater to both residential and commercial customers seeking sustainable energy solutions, aligning with the growing global demand for renewable energy. Tesla's investments in battery technology are also potentially lucrative. As battery technology improves and energy storage becomes more critical, Tesla's expertise could translate into licensing agreements or the supply of batteries to other companies, generating substantial revenue.

SpaceX, Musk's space exploration company, operates on a different revenue model. SpaceX's primary revenue source is launching satellites and cargo into orbit for both government and commercial clients. These launches utilize SpaceX's Falcon 9 and Falcon Heavy rockets, offering a cost-effective and reliable means of accessing space. Government contracts, particularly with NASA and the US Department of Defense, are vital to SpaceX's revenue. These contracts involve delivering cargo to the International Space Station, launching scientific payloads, and supporting national security missions. SpaceX is also developing Starlink, a satellite internet constellation designed to provide high-speed internet access to underserved areas globally. This initiative has the potential to generate substantial recurring revenue through subscription fees, transforming how people connect to the internet in remote regions. The development of Starship, SpaceX's next-generation spacecraft, opens up even more possibilities for revenue generation. Starship is designed for deep-space exploration, including missions to the Moon and Mars, and could potentially support space tourism and other commercial ventures in the future.

Beyond Tesla and SpaceX, Musk's other ventures also contribute to his overall wealth, though often in less direct ways. Neuralink, a company developing brain-computer interfaces, while still in the early stages of development, holds immense potential for future revenue. If successful, Neuralink's technology could revolutionize healthcare, enabling treatment for neurological disorders and potentially even enhancing human capabilities. The sale or licensing of Neuralink's technology could become a significant revenue stream. The Boring Company, which focuses on tunneling and infrastructure projects, aims to alleviate traffic congestion by building underground transportation systems. While the company is still relatively young, it has secured contracts for various projects and could generate revenue through construction, operation, and maintenance of these tunnels. Musk's influence and involvement in artificial intelligence also has the potential to impact his wealth, although the mechanisms are often indirect. His founding of OpenAI, a non-profit AI research company, is geared towards responsible AI development. Though OpenAI itself might not directly generate profit for Musk, its advancements in AI could indirectly benefit his other companies by improving their products and services.

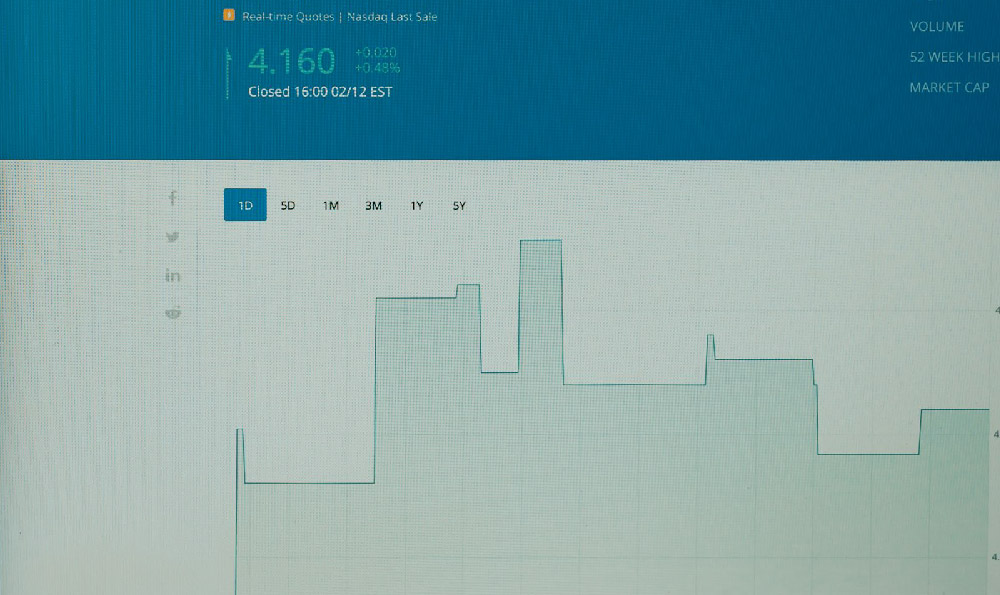

Another, less direct but equally important, revenue stream stems from Musk's personal brand and influence. His ability to generate hype and enthusiasm around his companies and products is unparalleled. This "Musk effect" translates into increased demand, higher stock prices, and ultimately, greater wealth. His social media presence, particularly on Twitter, is a powerful tool for shaping public perception and driving market sentiment. This influence also allows him to attract top talent and secure favorable deals, further contributing to the success of his ventures. Investment returns on company stocks and other assets are also a key element of Musk's revenue streams. As the value of his companies has grown, so has the value of his stock holdings, generating substantial capital gains. Smart investments in other companies and assets contribute to the diversification of his portfolio and further enhance his wealth.

In summary, Elon Musk's wealth is derived from a complex and diversified ecosystem of revenue streams. These streams include the sale of electric vehicles and energy products, the provision of space launch services, the development of cutting-edge technologies like brain-computer interfaces, and the power of his personal brand. His success lies not only in his ability to innovate and disrupt industries but also in his capacity to create compelling narratives that attract investors, customers, and talent. As Musk continues to pursue ambitious goals, from colonizing Mars to revolutionizing transportation, his revenue streams are likely to evolve and diversify further, solidifying his position as one of the world's wealthiest and most influential individuals.