Turning 65 often marks a significant life transition, retirement being the most prominent. However, for many, retirement doesn't necessarily equate to the end of their earning potential. Whether by necessity or choice, individuals over 65 can explore various avenues to generate income and maintain a comfortable, fulfilling lifestyle. The key to success lies in understanding the available options, realistically assessing personal skills and resources, and implementing a strategic approach.

One of the most common options is to continue working, either in the same field or a different one. Many employers are increasingly recognizing the value of experienced employees. Retaining older workers can be beneficial, as they often possess invaluable institutional knowledge, strong work ethics, and mentoring capabilities. This can manifest in several ways. Perhaps a phased retirement, where you gradually reduce your hours, allowing a smoother transition while maintaining a steady income stream. Or you might transition into a consulting role within your industry, leveraging your expertise on a project basis, offering greater flexibility and potentially higher hourly rates than traditional employment.

For those seeking a complete career change, the possibilities are vast, though require careful planning. Think about your passions, hobbies, and skills that can be monetized. A retired teacher could offer tutoring services, a former accountant could provide bookkeeping assistance to small businesses, or a gardening enthusiast could start a landscaping business. The rise of the gig economy has also opened doors to numerous freelance opportunities, from writing and editing to graphic design and virtual assistant services. Online platforms connect individuals with clients worldwide, offering a flexible and accessible way to earn money.

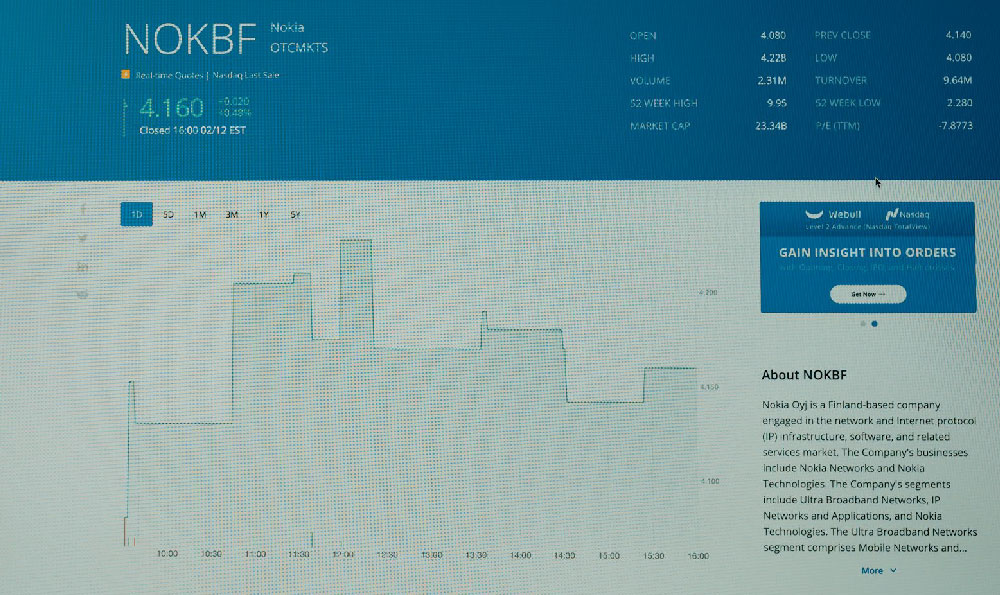

Another avenue to consider is investing. After 65, while capital preservation becomes a more significant concern, completely shying away from investments can be detrimental, especially considering inflation and potentially long lifespans. Diversifying your investment portfolio is crucial. While riskier investments like stocks might hold less appeal, a balanced approach that includes bonds, real estate investment trusts (REITs), and dividend-paying stocks can provide a steady income stream and protect your principal. Seeking professional financial advice is highly recommended, ensuring your investment strategy aligns with your risk tolerance, financial goals, and time horizon. Remember that past performance is not indicative of future results, and careful research and due diligence are always essential.

Real estate can also be a valuable source of income. If you own your home, consider renting out a spare room or converting part of your property into an Airbnb. This can generate substantial passive income, particularly in desirable locations. Downsizing to a smaller, less expensive home can free up capital that can be invested or used to supplement your income. Furthermore, investing in rental properties can provide a consistent revenue stream, although it requires active management or hiring a property manager. Understanding local market conditions, regulations, and potential tenant issues is vital before venturing into real estate investments.

Beyond traditional employment and investments, consider monetizing your existing assets and skills. Do you have valuable collectibles, antiques, or artwork? Selling them can provide a significant lump sum of money. Do you have expertise in a particular subject? Consider creating and selling online courses or writing and self-publishing a book. The internet provides a powerful platform to reach a wide audience and generate income from your knowledge and skills.

Regardless of the chosen path, careful financial planning is paramount. Develop a realistic budget that outlines your expenses and income. Identify areas where you can reduce spending without compromising your quality of life. Consider the tax implications of any income-generating activities. Consulting with a tax advisor can help you minimize your tax burden and maximize your net income.

One often overlooked aspect is maintaining good health and staying active. Health issues can significantly impact your ability to work and generate income. Prioritizing your physical and mental well-being is an investment in your long-term financial security. Engage in regular exercise, maintain a healthy diet, and stay socially connected. These activities can not only improve your quality of life but also extend your earning potential.

Finally, stay informed and adaptable. The economic landscape is constantly evolving. New technologies, industries, and investment opportunities emerge regularly. Continuously update your knowledge and skills to remain relevant and competitive. Be open to trying new things and adjusting your strategies as needed. Embrace lifelong learning and view retirement as an opportunity to explore new interests and pursue new income streams. Success after 65 is not just about earning money; it's about maintaining a sense of purpose, staying engaged, and living a fulfilling life. It requires a proactive approach, realistic expectations, and a willingness to adapt to changing circumstances. By carefully considering your options, developing a sound financial plan, and staying healthy and engaged, you can create a financially secure and rewarding chapter in your life.