The allure of quick riches often leads investors down paths paved with complex strategies, and the Martingale system, adapted for cryptocurrency trading, is a prime example. CoinPro Martingale Simulation Tool, or any similar tool promising effortless profits through this strategy, warrants a thorough examination to determine its efficacy and potential pitfalls.

The Martingale strategy, at its core, is remarkably simple. It originates from gambling, where the idea is to double your bet after each loss, ensuring that when you eventually win, you recover all previous losses and achieve a profit equal to your initial stake. In the context of cryptocurrency trading, this translates to doubling your investment amount after each losing trade, betting that the market will eventually reverse and allow you to recoup your losses.

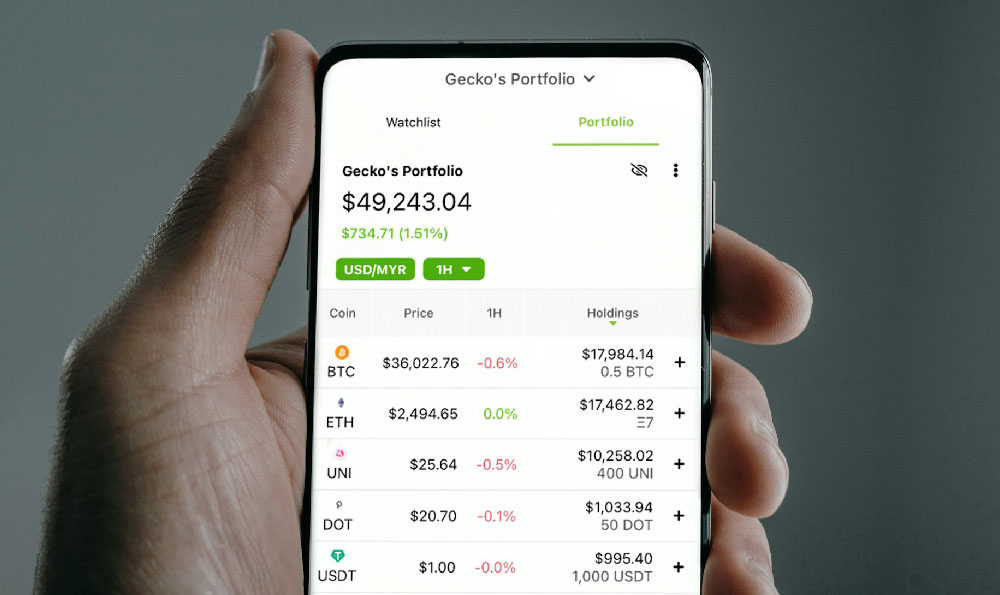

CoinPro and other similar simulation tools attempt to automate this process, claiming to provide a safe and efficient way to implement the Martingale strategy in the volatile cryptocurrency market. They often offer features like customizable risk parameters, backtesting capabilities, and automated trading bots designed to execute trades based on the Martingale principle. While the initial premise may seem appealing, a critical analysis reveals several inherent limitations and risks.

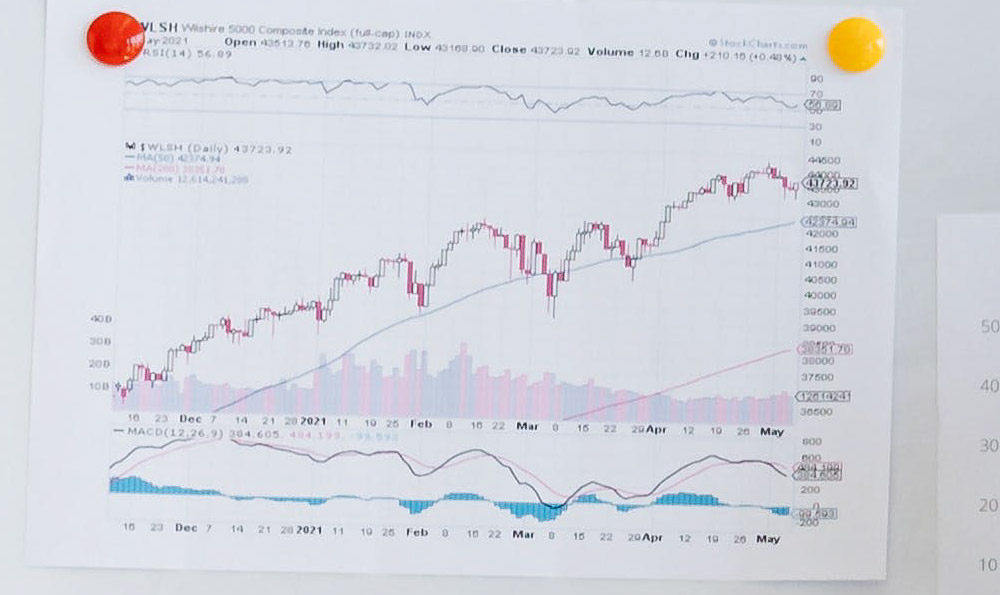

One of the biggest issues with applying the Martingale strategy to cryptocurrency trading is the assumption of unlimited capital. The system relies on the ability to continuously double your investment size after each loss. In reality, every trader has a finite amount of capital. A series of consecutive losing trades can quickly deplete your funds, forcing you to abandon the strategy before a winning trade materializes. The cryptocurrency market, known for its extreme volatility and sudden crashes, makes this scenario highly plausible. Consider a scenario where Bitcoin experiences a significant correction. If you are employing the Martingale strategy on a long position, you will be required to continually double down on your investment as the price declines. This can quickly lead to margin calls, account liquidation, and substantial financial losses.

Furthermore, the Martingale strategy inherently involves high risk-reward ratios. While the potential profit from a winning trade is relatively small (equal to your initial stake), the potential losses can be exponentially larger. This skewed risk profile makes the strategy unsuitable for risk-averse investors or those with limited capital. Even with sophisticated simulation tools, backtesting results can be misleading. Historical data may not accurately reflect future market conditions. The cryptocurrency market is constantly evolving, and factors like regulatory changes, technological advancements, and shifts in investor sentiment can significantly impact price movements. A strategy that performed well in the past may not necessarily be profitable in the future.

The "CoinPro" part of the tool name suggests a focus on cryptocurrency, and that specialization itself can be a concern. The cryptocurrency market operates 24/7 and is global in nature. The strategies deployed, therefore, require an understanding of these facets. Simulation tools often fail to incorporate factors like slippage (the difference between the expected price and the actual price at which a trade is executed) and trading fees, which can significantly erode profits, especially when executing frequent trades, as required by the Martingale strategy. These factors are exacerbated in less liquid cryptocurrencies, making Martingale even more dangerous.

Another critical consideration is the psychological aspect of trading. The Martingale strategy can be emotionally taxing, especially during losing streaks. The pressure to double down after each loss can lead to impulsive decisions and deviations from the pre-defined trading plan. This can further increase the risk of losses and undermine the effectiveness of the strategy.

Beyond the inherent flaws of the Martingale system, it's important to question the claims made by the providers of these simulation tools. Some companies may exaggerate the potential returns and downplay the risks associated with the strategy to attract users. Thoroughly research the provider's reputation and credibility before entrusting them with your capital. Look for independent reviews and testimonials from other users. Be wary of any tool that guarantees profits or promises unrealistic returns. No trading strategy, including the Martingale system, can guarantee success in the volatile cryptocurrency market.

Instead of relying solely on automated tools and complex strategies, consider building a solid foundation of investment knowledge. Learn about fundamental analysis (evaluating the intrinsic value of a cryptocurrency project), technical analysis (analyzing price charts and patterns), and risk management principles. Develop a well-defined trading plan that aligns with your financial goals and risk tolerance. Diversify your portfolio across different cryptocurrencies and asset classes to mitigate risk.

In conclusion, while the CoinPro Martingale Simulation Tool may seem like an appealing way to profit from the cryptocurrency market, it's crucial to approach it with caution. The Martingale strategy is inherently risky and requires a significant amount of capital to implement effectively. Simulation tools may not accurately reflect real-world trading conditions and can lead to misleading results. Rather than relying on quick-fix solutions, focus on building a solid foundation of investment knowledge and developing a well-defined trading plan. Remember, responsible investing is about managing risk and achieving long-term financial goals, not chasing after unrealistic promises of overnight riches. A healthy dose of skepticism and thorough due diligence are essential when evaluating any investment strategy or tool, especially in the dynamic and often unpredictable world of cryptocurrency.