The intersection of part-time work and Social Security benefits is a common concern, especially for those approaching or already in retirement. The good news is, yes, it's generally possible to work part-time while receiving Social Security benefits. However, it's crucial to understand the rules and potential impact on your benefits, particularly if you're claiming benefits before your full retirement age (FRA).

Let's delve into the specifics. The Social Security Administration (SSA) has specific regulations concerning earnings limits if you're receiving benefits before your FRA. FRA varies based on your year of birth. For individuals born between 1943 and 1954, FRA is 66. For those born after 1954, FRA gradually increases, reaching 67 for individuals born in 1960 or later.

If you're under your FRA for the entire year, there's an annual earnings limit. For 2024, this limit is $22,320. If your earnings exceed this amount, the SSA will deduct $1 from your benefits for every $2 you earn above the limit. This doesn't mean you lose the money forever. Instead, your benefits are recalculated at your FRA to account for the months you didn't receive full benefits due to the earnings limit. In essence, you'll receive a higher monthly benefit later on.

The year you reach your FRA is different. In 2024, the earnings limit for the year you reach FRA is $59,520. Furthermore, the deduction is less severe: the SSA will deduct $1 from your benefits for every $3 you earn above this limit. Crucially, this limit applies only to earnings before the month you reach your FRA. Once you reach your FRA, there's no earnings limit. You can earn as much as you want without affecting your Social Security benefits.

Consider this example: Sarah, born in 1962, claims Social Security benefits at age 62 in 2024. Her annual earnings from a part-time job total $30,000. Because this exceeds the $22,320 limit by $7,680, the SSA will deduct $3,840 ($7,680 / 2) from her Social Security benefits for the year. While this reduces her benefits in the short term, her monthly benefit will be adjusted upward once she reaches her FRA.

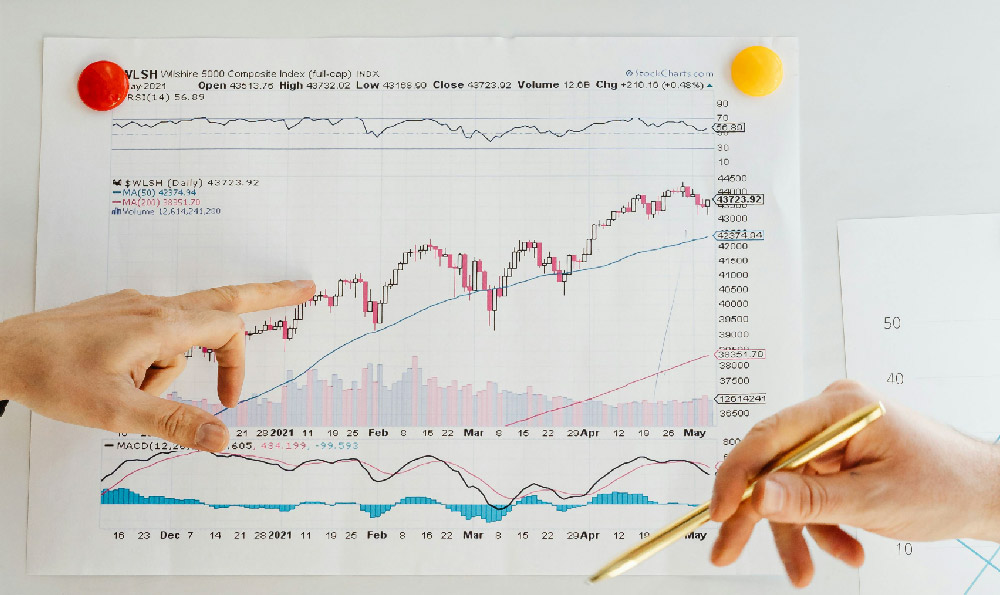

Now, let's discuss strategies for managing your earnings while receiving Social Security benefits. First, carefully estimate your potential earnings for the year. If you anticipate exceeding the earnings limit, consider reducing your work hours or taking on lower-paying tasks. Open communication with your employer is crucial to ensure you're on track to stay within the limit.

Another strategy involves strategic timing of your work. If you're close to your FRA, try to maximize your earnings before you reach that age. Once you reach your FRA, you can increase your work hours without any impact on your benefits. Furthermore, understand that not all income counts towards the earnings limit. Income from investments, pensions, or annuities generally doesn't affect your Social Security benefits. Only earned income, such as wages and self-employment income, is considered.

Self-employed individuals face unique considerations. The SSA defines self-employment income as net earnings after deducting business expenses. Therefore, maximizing legitimate business deductions can help reduce your net earnings and potentially keep you below the earnings limit. Keep meticulous records of all business income and expenses.

It's vital to understand that the earnings limit applies only to retirement benefits. It does not apply to survivor benefits or disability benefits. The rules for these types of benefits are different. If you're receiving survivor benefits, your earnings may still impact your benefits, but the specific rules differ slightly. Disability benefits have stricter work-related rules, and earning too much can lead to a review of your disability status.

Mistakes in reporting earnings can lead to penalties. If you underestimate your earnings and the SSA overpays you, you may be required to repay the overpayment. Therefore, it's essential to be accurate and honest when reporting your earnings to the SSA. The SSA offers resources and tools to help you estimate your earnings and understand the impact on your benefits. Take advantage of these resources to avoid any potential issues.

Furthermore, be aware of the potential tax implications of working while receiving Social Security benefits. Depending on your income level, your Social Security benefits may be taxable. This is another reason to carefully manage your earnings and consider consulting with a tax advisor to minimize your tax liability. The IRS provides specific guidelines on the taxation of Social Security benefits.

In conclusion, working part-time while receiving Social Security benefits is possible, but requires careful planning and adherence to the SSA's rules. Understanding the earnings limits, strategically managing your work hours, and accurately reporting your earnings are crucial for maximizing your benefits and avoiding penalties. Don't hesitate to consult with a financial advisor or contact the SSA directly for personalized guidance. They can help you navigate the complexities of Social Security and develop a strategy that aligns with your individual circumstances and financial goals. Remember that knowledge and proactive planning are your best tools for securing a comfortable retirement.