```

Navigating the Decentralized World: Buying ETH on Uniswap and Evaluating Keepbit

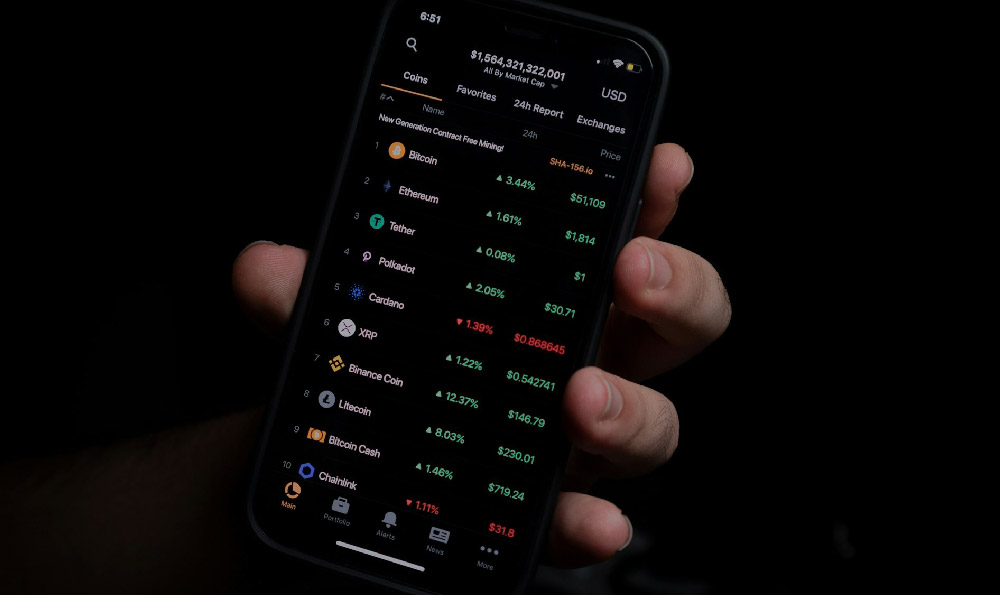

The world of cryptocurrency can feel like a vast and ever-changing ocean. Two common questions that arise for newcomers and seasoned crypto enthusiasts alike are: "Can I buy ETH on Uniswap?" and "Is Keepbit a good credit card platform?" Let's break down each of these inquiries to provide a clearer understanding and guide your decision-making process.

Buying ETH on Uniswap: A Step-by-Step Guide

Uniswap is a decentralized exchange (DEX) built on the Ethereum blockchain. This means it operates without a central intermediary, allowing users to trade cryptocurrencies directly with each other. Buying ETH (Ether, the native cryptocurrency of Ethereum) on Uniswap is indeed possible and, for many, a preferred method due to its decentralized nature. However, it requires a foundational understanding of decentralized finance (DeFi).

First and foremost, you will need an Ethereum wallet. MetaMask is a popular and widely used option, available as a browser extension and mobile app. Once installed, you need to secure your wallet with a strong password and carefully store your seed phrase (a series of words that allows you to recover your wallet if you lose access). Treat your seed phrase like gold, as anyone who has it can access your funds.

Next, you need to fund your wallet with another cryptocurrency that can be traded for ETH. This typically involves transferring stablecoins like USDT or USDC, or other ERC-20 tokens (tokens built on the Ethereum blockchain), to your MetaMask wallet from a centralized exchange like Coinbase or Binance, or from another wallet you control. Remember that you will need a small amount of ETH in your wallet to pay for gas fees, which are the transaction fees required to execute trades on the Ethereum network.

Now you can navigate to the Uniswap interface. Make sure you are using the official Uniswap website to avoid phishing scams. Connect your MetaMask wallet to the Uniswap platform. Once connected, you can select the token you want to trade from (e.g., USDT) and the token you want to trade to (ETH).

Uniswap will display an estimated exchange rate and the amount of ETH you will receive. Pay close attention to the "slippage tolerance." Slippage refers to the difference between the expected price and the actual price you receive due to price fluctuations during the transaction. Setting a higher slippage tolerance can help ensure your transaction goes through, but it may result in you receiving slightly less ETH than anticipated.

Finally, click "Swap" and confirm the transaction in your MetaMask wallet. MetaMask will show you the estimated gas fees. You can usually choose between different gas fee options (e.g., "slow," "average," "fast") depending on how quickly you want the transaction to be processed. Keep in mind that gas fees can fluctuate significantly depending on network congestion. After confirming, your transaction will be broadcast to the Ethereum network and, once confirmed, your ETH will appear in your MetaMask wallet.

Potential Risks of Using Uniswap

While Uniswap offers a decentralized way to acquire ETH, it's important to be aware of the risks involved. Impermanent loss is a key risk if you decide to provide liquidity to Uniswap pools. Smart contract vulnerabilities, although rare, are also a possibility with any DeFi platform. Always do your own research (DYOR) before interacting with any DeFi protocol.

Keepbit: Evaluating a Credit Card Platform in the Crypto Space

Keepbit, like other crypto-linked credit card platforms, aims to bridge the gap between traditional finance and the world of cryptocurrency. These platforms typically offer rewards, such as cashback or crypto rewards, for using their credit cards for everyday purchases.

Key Considerations When Evaluating Keepbit (or any similar platform):

- Rewards Structure: What percentage of your spending do you receive back in rewards? Are the rewards paid out in cryptocurrency, and if so, which one? What is the volatility of the rewarded cryptocurrency? Are there any limits to the amount of rewards you can earn?

- Fees and Interest Rates: What are the annual fees associated with the card? What are the interest rates if you carry a balance? Are there any transaction fees for converting crypto rewards to fiat currency? These fees can quickly negate any rewards you earn, so understanding them is crucial.

- Security: How does the platform protect your personal and financial information? What security measures are in place to prevent fraud and unauthorized access to your account? Are they using multi-factor authentication?

- User Experience: Is the platform easy to use and navigate? Is customer support readily available and responsive? Can you easily track your spending and rewards?

- Reputation: What are other users saying about their experience with the platform? Are there any reports of security breaches or other issues? Look for reviews on independent websites and forums.

Is Keepbit a "Good" Platform?

The answer to this question depends on your individual needs and risk tolerance. There's no one-size-fits-all answer. A "good" platform for one person might not be a "good" platform for another.

Instead of directly endorsing or dismissing Keepbit, let’s look at the types of concerns that users of crypto-linked cards often express:

- Regulation & Compliance: Given the evolving regulatory landscape surrounding cryptocurrency, it's important to be aware of potential regulatory risks. Ensure that the platform is compliant with applicable laws and regulations in your jurisdiction.

- Tax Implications: Earning crypto rewards may have tax implications. Consult with a tax professional to understand your tax obligations.

- Volatility: Crypto rewards can fluctuate in value, so the value of your rewards could decrease significantly over time.

Before applying for a Keepbit credit card (or any similar crypto-linked card), carefully consider the risks and rewards involved. Read the fine print, compare different platforms, and make sure you understand the terms and conditions.

In conclusion, both buying ETH on Uniswap and using crypto-linked credit card platforms like Keepbit offer exciting opportunities to participate in the digital economy. However, they also come with inherent risks that need to be carefully evaluated. By understanding the underlying principles and conducting thorough research, you can make informed decisions and navigate the decentralized world with greater confidence. Always prioritize security and due diligence. Remember, informed investing is the best investing. ```