Okay, I understand. Here's an article based on the given title, focusing on providing comprehensive investment advice while avoiding excessive bullet points and formal transitions, and adhering to the requested word count:

The quest for optimal investments is a journey unique to each individual, shaped by their financial circumstances, risk tolerance, and long-term objectives. There is no single "best" investment that universally guarantees success. Instead, the ideal investment strategy is a carefully constructed mosaic, tailored to the investor's specific needs and aspirations. Understanding the fundamental principles of investing, exploring diverse asset classes, and regularly reviewing your portfolio are crucial steps on this path.

Before diving into specific investment vehicles, it's essential to lay a solid foundation. This begins with a clear understanding of your financial goals. Are you saving for retirement, a down payment on a house, your children's education, or simply seeking to grow your wealth over time? The timeframe associated with each goal will significantly impact your investment choices. Short-term goals require more conservative investments, while long-term goals allow for greater risk-taking potential.

Risk tolerance is another critical factor. Are you comfortable with the possibility of losing a portion of your investment in exchange for the potential for higher returns, or do you prefer a more stable, albeit potentially less lucrative, approach? Accurately assessing your risk tolerance is paramount to avoid making emotional decisions during market fluctuations. A fluctuating market may provide new opportunities, and understanding risk tolerance helps to determine if those opportunities are right for you.

With these fundamentals in place, we can explore the vast landscape of investment options. Stocks, or equities, represent ownership in a company and offer the potential for significant capital appreciation. However, they are also subject to market volatility and carry a higher level of risk. Diversification is key when investing in stocks, spreading your investments across various sectors, industries, and geographic regions. You can achieve this through individual stock selection or by investing in broad-market index funds or Exchange Traded Funds (ETFs), which offer instant diversification and lower expense ratios.

Bonds, on the other hand, represent loans to governments or corporations. They generally offer lower returns than stocks but are also considered less risky. Bonds provide a steady stream of income through interest payments and can act as a stabilizing force in a portfolio, particularly during economic downturns. Like stocks, bond investments can be diversified through individual bond purchases or bond funds.

Real estate represents another significant asset class. Investing in real estate can provide rental income, potential capital appreciation, and diversification benefits. However, real estate investments also come with their own set of challenges, including property management responsibilities, potential vacancies, and illiquidity. Real Estate Investment Trusts (REITs) offer a way to invest in real estate without directly owning physical properties, providing diversification and liquidity.

Beyond these core asset classes, there are alternative investments, such as commodities, precious metals, and private equity. These investments can offer unique diversification benefits and potentially higher returns, but they are often more complex and require specialized knowledge. They also come with a greater degree of risk and may be less liquid than traditional investments.

Modern portfolios also often consider including cryptocurrency assets. These highly volatile digital assets can provide outsized returns, but are also subject to significant price swings, and should be carefully considered prior to investing. Investing in cryptocurrencies is more akin to speculation than traditional investment, and should only be considered by investors with a high risk tolerance.

The allocation of your investments across these asset classes is known as asset allocation. This is perhaps the most critical decision you will make as an investor. A well-designed asset allocation strategy aligns with your risk tolerance, time horizon, and financial goals. There are numerous asset allocation models available, ranging from conservative to aggressive, and it's essential to choose one that suits your individual circumstances.

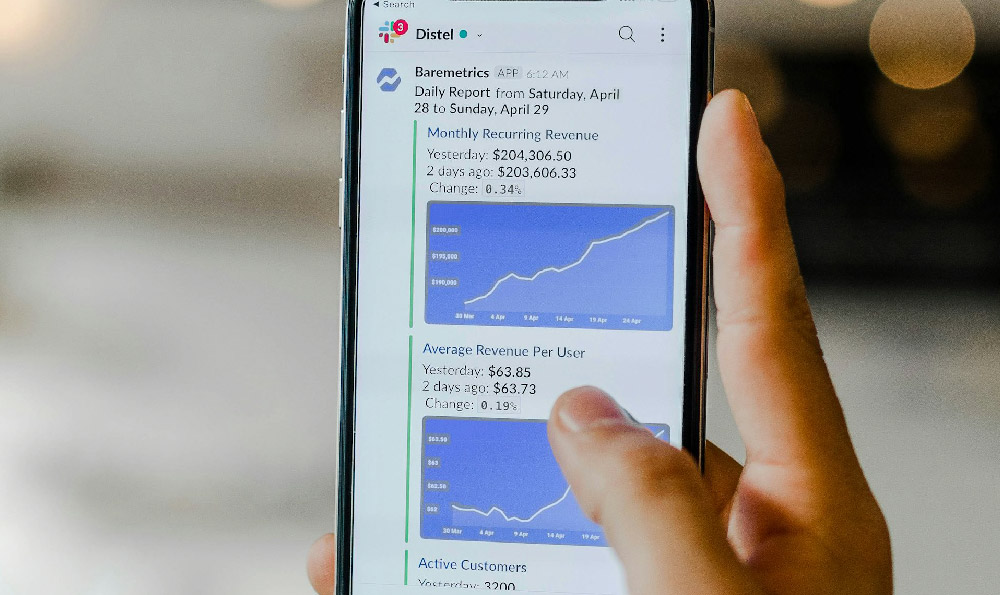

Beyond initial asset allocation, maintaining a disciplined approach to investing is crucial. This includes regularly reviewing your portfolio, rebalancing your asset allocation, and staying informed about market trends. Rebalancing involves periodically adjusting your portfolio to maintain your desired asset allocation. For example, if stocks have outperformed bonds, you may need to sell some stocks and buy more bonds to bring your portfolio back into balance.

Staying informed about market trends and economic developments is also essential. While you don't need to become a market expert, understanding the factors that can influence investment performance will help you make more informed decisions. Staying informed will also allow you to quickly identify new opportunities as well as react to developing threats to your investments.

Investing is a continuous learning process. It requires patience, discipline, and a willingness to adapt to changing market conditions. Consider seeking guidance from a qualified financial advisor who can help you develop a personalized investment strategy and provide ongoing support. A financial advisor can also help you navigate the complexities of investing and avoid common pitfalls.

Ultimately, the best investments are the ones that align with your individual goals, risk tolerance, and time horizon. By understanding the fundamentals of investing, exploring diverse asset classes, and maintaining a disciplined approach, you can increase your chances of achieving your financial objectives and building a secure financial future. Remember, investing is a marathon, not a sprint, and consistent effort over time is key to long-term success. Consider diversification and don't put all your eggs in one basket.