Audible Income: The idea of generating income simply by listening to something sounds almost too good to be true. In today's complex financial landscape, exploring various avenues for wealth creation is essential, and the concept of "audible income," particularly related to cryptocurrency and related investments, warrants a closer examination. It's important to clarify upfront: there's no magical way to make money simply by passively listening. True "audible income," in this context, is about actively engaging with information, analyzing it, and then leveraging that knowledge for strategic investment decisions within the cryptocurrency space.

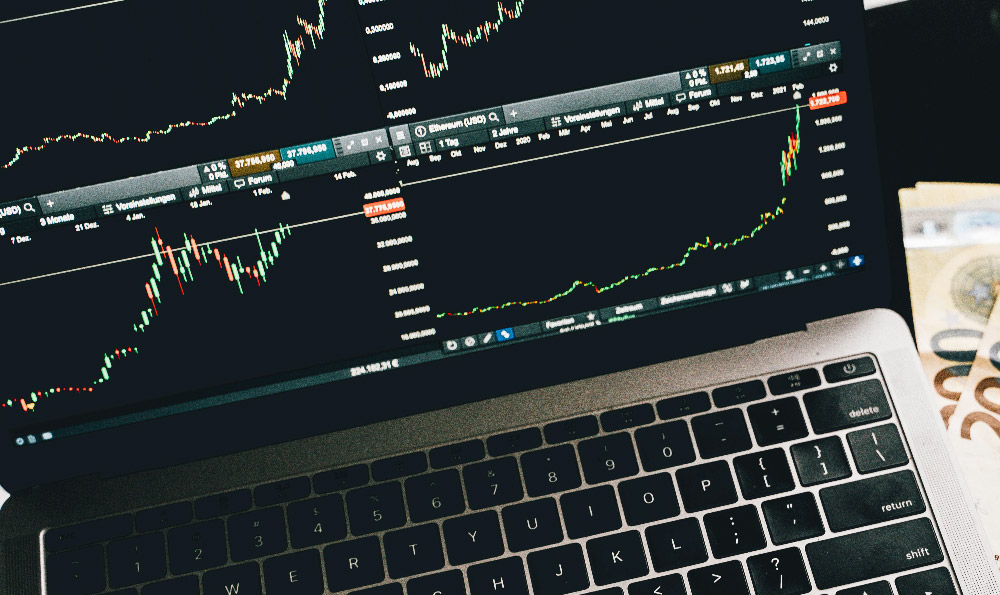

The reality is that the cryptocurrency market is volatile and complex. Success depends not on luck, but on a solid understanding of market dynamics, technical analysis, and risk management strategies. Where does the "audible" component come into play? It lies in the continuous consumption of information crucial for navigating this dynamic market. Think of podcasts, audiobooks, webinars, and even recorded market analysis reports as your learning tools. These resources, when actively listened to and critically analyzed, provide the raw material needed to build your investment strategy.

To genuinely profit from "audible income" in the crypto world, the process can be broken down into several key components. First, you need to curate your sources carefully. Not all information is created equal. Be discerning about the podcasts, YouTubers, and analysts you follow. Look for individuals and organizations with a proven track record, a deep understanding of blockchain technology, and a transparent investment philosophy. Cross-reference information from multiple sources to avoid biases and ensure a well-rounded perspective. A critical red flag is someone constantly shilling specific coins without explaining the underlying fundamentals or risks. Independent research and due diligence are non-negotiable.

Next, develop a framework for active listening. Don’t just passively absorb information; actively engage with it. Take notes, highlight key points, and formulate questions. Consider the speaker’s biases, motivations, and the overall context of their analysis. Try to understand the logic behind their predictions and identify the data points they are using to support their claims. A good practice is to try and debate the points made in your own mind – play devil's advocate to challenge your own assumptions and understanding. This process will force you to think critically and solidify your grasp on the material.

The information you gain from listening needs to be translated into a coherent investment strategy. This involves defining your risk tolerance, setting realistic financial goals, and diversifying your portfolio. Are you a conservative investor who prioritizes capital preservation, or are you willing to take on more risk for the potential of higher returns? Your investment choices should reflect your individual circumstances and comfort level. Don’t put all your eggs in one basket. Diversification across different cryptocurrencies and asset classes can help mitigate risk.

Technical analysis, often discussed in audible resources, is a powerful tool for identifying potential entry and exit points. Learning to read charts, understand indicators like moving averages and relative strength index (RSI), and recognize patterns can significantly improve your trading decisions. However, remember that technical analysis is not foolproof, and it should be used in conjunction with fundamental analysis and an understanding of market sentiment.

Beyond technical skills, understanding fundamental analysis is equally important. This involves evaluating the underlying technology, the team behind the project, the use case, and the overall market potential of a cryptocurrency. Is the project solving a real-world problem? Does it have a strong team with a proven track record? Is the technology scalable and secure? These are all critical questions to ask before investing in any cryptocurrency.

Risk management is paramount in the cryptocurrency market. Never invest more than you can afford to lose, and always use stop-loss orders to limit your potential losses. Be prepared for volatility and avoid making emotional decisions based on fear or greed. Having a clear exit strategy is crucial, so you know when to take profits or cut your losses. Setting price targets and sticking to them can help you avoid the trap of holding on to losing positions for too long.

The market is constantly evolving, and staying informed is an ongoing process. Make a habit of continuously learning and adapting your investment strategy as the market changes. Attend online webinars, read industry reports, and participate in online communities to stay abreast of the latest developments. Don't be afraid to experiment with new strategies, but always do your research first and test them in a small, controlled environment before committing significant capital.

Finally, be wary of scams and fraudulent schemes. The cryptocurrency market is rife with scams promising quick riches, so be skeptical of anything that sounds too good to be true. Never give out your private keys or personal information, and always be cautious about clicking on links from unknown sources. Do your research and only invest in legitimate projects with transparent teams and sound fundamentals.

In conclusion, while "audible income" in its purest, most passive form is a misnomer, actively and strategically consuming audio-based information can be a valuable tool for building knowledge and making informed investment decisions in the cryptocurrency market. Success requires diligence, critical thinking, and a commitment to continuous learning. By combining quality information sources with sound investment principles and robust risk management strategies, you can increase your chances of generating real, sustainable returns in the long run. Remember, knowledge is power, and in the world of cryptocurrency, informed decisions are the key to unlocking financial opportunities.