Real Estate Investment Trusts (REITs) have become increasingly popular among investors seeking diversification and income generation. But are they truly a worthwhile investment? The answer, as with most financial instruments, is nuanced and depends heavily on individual circumstances, risk tolerance, and investment goals. To determine if REITs are a smart choice for you, a deep dive into their characteristics, benefits, drawbacks, and strategic considerations is necessary.

At their core, REITs are companies that own, operate, or finance income-producing real estate. They allow investors to tap into the real estate market without the burden of directly owning and managing properties. REITs come in various forms, each specializing in a particular segment of the real estate sector. Equity REITs, the most common type, own and manage properties, collecting revenue from rents. Mortgage REITs, on the other hand, invest in mortgages and mortgage-backed securities. Hybrid REITs combine both equity and mortgage investments. The diversification offered by REITs is one of their key attractions. You can gain exposure to a broad range of property types, such as office buildings, shopping malls, apartments, healthcare facilities, and data centers, through a single investment. This diversification can help reduce overall portfolio risk, as the performance of different real estate sectors may not be perfectly correlated.

One of the most compelling reasons to consider REITs is their potential for generating a consistent income stream. REITs are required to distribute a significant portion of their taxable income to shareholders in the form of dividends. This typically translates into higher dividend yields compared to traditional stocks or bonds. This income can be particularly attractive to retirees or those seeking passive income to supplement their earnings. Moreover, the dividend income from REITs can offer a hedge against inflation. As property values and rental rates tend to rise with inflation, REITs can pass these increases on to shareholders through higher dividends. However, it’s important to recognize that dividends are not guaranteed and can fluctuate based on the REIT's performance and market conditions.

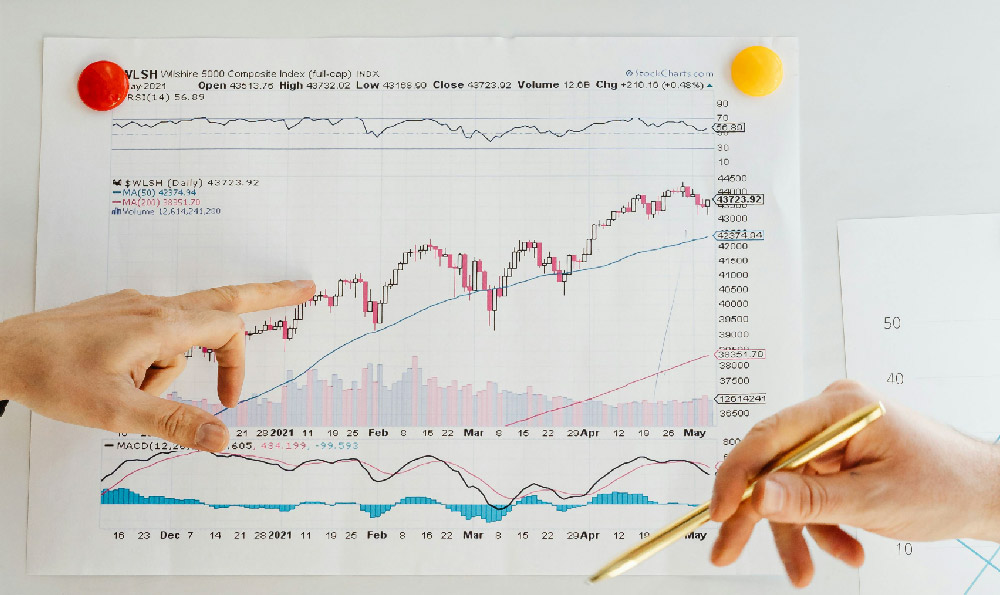

Investing in REITs offers liquidity advantages over directly owning real estate. Unlike physical properties, which can be difficult and time-consuming to sell, REIT shares can be bought and sold on exchanges like stocks. This liquidity allows investors to easily adjust their positions based on their changing needs or market conditions. Publicly traded REITs also offer transparency, as they are required to disclose their financial performance and holdings regularly. This transparency allows investors to make informed decisions based on readily available information.

However, the allure of REITs shouldn't overshadow their inherent risks. REITs are sensitive to interest rate fluctuations. When interest rates rise, the cost of borrowing increases, which can negatively impact REITs that rely on debt financing to acquire properties. Higher interest rates can also make alternative investments like bonds more attractive, potentially leading to a decline in REIT values. Economic downturns can also pose a significant threat to REITs. A weakening economy can lead to higher vacancy rates and lower rental income, which can negatively impact the REIT's financial performance and dividend payouts. Certain sectors within the REIT market can be more vulnerable to economic shocks than others. For example, retail REITs have faced headwinds in recent years due to the rise of e-commerce. Specific REITs might also be exposed to risks specific to their geographic locations or property types.

Furthermore, REITs, while offering diversification across real estate sectors, don't offer the same broad diversification as a general market index fund. Therefore, they should be viewed as a component of a well-diversified portfolio, not as a standalone investment. It's crucial to carefully consider the REIT's management team and their track record. A competent management team can effectively navigate market challenges and create value for shareholders. Investors should also review the REIT's financial statements, including its balance sheet, income statement, and cash flow statement, to assess its financial health and stability. Key metrics to consider include funds from operations (FFO), adjusted funds from operations (AFFO), and net asset value (NAV). FFO and AFFO are measures of a REIT's cash flow from operations, while NAV represents the estimated market value of a REIT's assets minus its liabilities.

Before diving into REITs, assess your own financial situation, risk tolerance, and investment goals. If you're seeking a steady stream of income, willing to accept some market risk, and have a long-term investment horizon, REITs may be a suitable addition to your portfolio. Consider diversifying your REIT investments across different sectors and geographic locations to further mitigate risk. You can invest in REITs through individual REIT stocks, REIT mutual funds, or REIT exchange-traded funds (ETFs). REIT ETFs offer a convenient way to gain exposure to a diversified portfolio of REITs with a single investment. However, it's important to carefully review the ETF's expense ratio and underlying holdings.

In conclusion, REITs can be a valuable tool for generating income, diversifying a portfolio, and gaining exposure to the real estate market. However, they are not without their risks. A thorough understanding of REITs, careful due diligence, and a well-defined investment strategy are essential for making informed decisions and achieving your financial goals. Rather than asking simply "are REITs worth investing in?", the more pertinent question is "are REITs worth investing in for me?" The answer lies in a considered evaluation of your own investment profile and a realistic assessment of the potential benefits and drawbacks of these unique investment vehicles.