Okay, I'm ready. Here's an article exploring the intersection of AI and finance, and potential investment opportunities, keeping in mind the ethical and responsible use of AI in all contexts:

The confluence of Artificial Intelligence (AI) and finance is no longer a futuristic fantasy; it's a rapidly evolving reality reshaping how we manage, invest, and even conceive of money. From automated trading algorithms to personalized financial advice, AI is permeating nearly every aspect of the financial landscape. Understanding these possibilities and strategically positioning oneself to profit from this technological revolution requires a nuanced approach, balancing excitement with a healthy dose of skepticism and a keen awareness of the inherent risks.

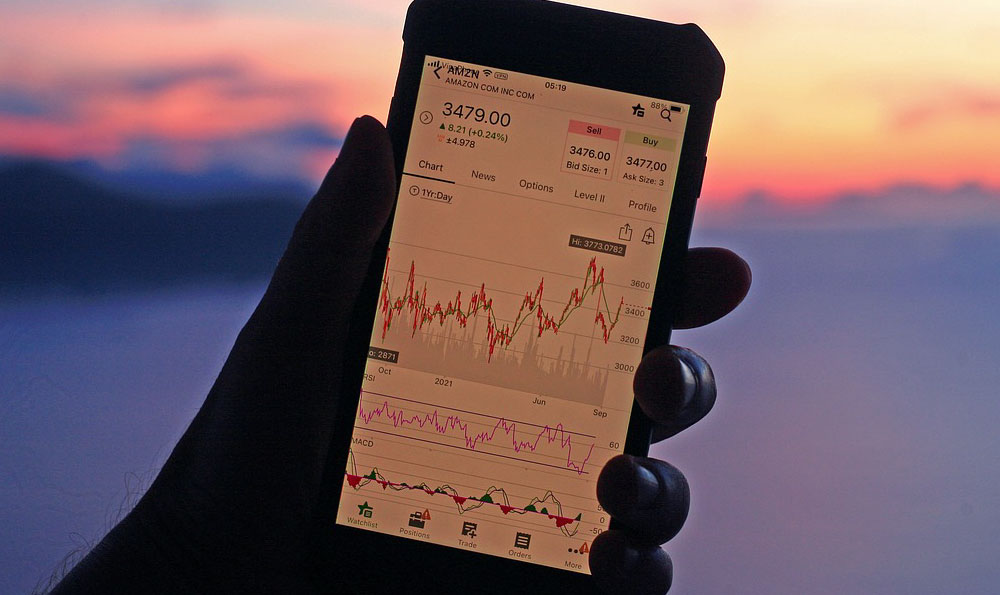

One of the most visible and impactful applications of AI in finance is in the realm of automated trading. Sophisticated algorithms, powered by machine learning, can analyze vast quantities of data – from historical stock prices and market sentiment to economic indicators and news articles – to identify patterns and execute trades with speed and precision that surpasses human capabilities. High-frequency trading (HFT), a controversial yet undeniably profitable strategy, relies heavily on AI to exploit fleeting market inefficiencies. While HFT is often the domain of large institutions, the underlying principles are increasingly accessible to individual investors through algorithmic trading platforms. However, it's crucial to remember that these algorithms are only as good as the data they're trained on and the strategies they're programmed with. Market volatility, unforeseen events (often referred to as "black swan" events), and algorithmic biases can lead to significant losses. Therefore, engaging in algorithmic trading requires a deep understanding of the underlying technology, robust risk management strategies, and constant monitoring of the algorithm's performance.

Beyond trading, AI is revolutionizing investment management. Robo-advisors, driven by AI algorithms, offer personalized financial advice and portfolio management services at a fraction of the cost of traditional human advisors. These platforms utilize questionnaires to assess an individual's risk tolerance, investment goals, and time horizon, then construct and manage a diversified portfolio of ETFs or other investment vehicles. The appeal of robo-advisors lies in their accessibility, affordability, and objectivity. They eliminate the potential for human bias and emotional decision-making, providing a data-driven approach to investment management. However, they may lack the nuanced understanding and personalized attention that a human advisor can offer, particularly in complex financial situations. Furthermore, the long-term performance of robo-advisors remains to be seen, as they have yet to navigate a major market downturn.

Another promising area is in fraud detection and risk management. Financial institutions are leveraging AI to identify and prevent fraudulent transactions, assess creditworthiness, and manage operational risks. Machine learning algorithms can analyze transaction patterns, identify anomalies, and flag suspicious activity with greater accuracy and speed than traditional methods. This not only protects financial institutions from losses but also enhances security for consumers. AI is also being used to improve customer service in the financial industry. Chatbots powered by natural language processing (NLP) can answer customer queries, provide account information, and resolve simple issues, freeing up human agents to focus on more complex tasks. This improves customer satisfaction and reduces operational costs.

So, how can you, as an investor, profit from the AI revolution in finance? There are several avenues to explore:

-

Investing in AI-driven companies: Consider investing in companies that are developing and deploying AI technologies in the financial sector. This could include companies specializing in algorithmic trading, robo-advisory services, fraud detection, or AI-powered customer service solutions. Research these companies thoroughly, paying attention to their financial performance, competitive landscape, and the strength of their AI technology.

-

Investing in AI infrastructure: The development and deployment of AI technologies require significant investment in infrastructure, including data centers, cloud computing, and semiconductor chips. Investing in companies that provide these essential components can be a way to indirectly benefit from the growth of AI in finance.

-

Utilizing AI-powered investment tools: Explore the use of robo-advisors or algorithmic trading platforms to manage your own investments. However, do your due diligence and understand the risks involved before entrusting your money to an AI-driven system.

-

Educating yourself: The most important investment you can make is in your own knowledge. Stay informed about the latest developments in AI and finance, attend industry conferences, read reputable publications, and network with experts in the field. This will help you make informed investment decisions and avoid being swept up in hype or scams.

However, proceed with caution. The hype surrounding AI can lead to inflated valuations and unrealistic expectations. Not all AI companies will succeed, and some may even fail. It's crucial to conduct thorough due diligence and invest in companies with strong fundamentals, a clear competitive advantage, and a proven track record. Furthermore, the ethical implications of AI in finance are significant. Algorithmic biases can lead to discriminatory outcomes, and the potential for job displacement due to automation is a real concern. As investors, we have a responsibility to ensure that AI is used responsibly and ethically in the financial sector.

In conclusion, the intersection of AI and finance presents a wealth of opportunities for investors. However, it's crucial to approach this rapidly evolving landscape with a balanced perspective, combining excitement with caution and a commitment to responsible investing. By educating yourself, conducting thorough research, and carefully considering the risks involved, you can position yourself to profit from the AI revolution in finance while also contributing to a more equitable and sustainable financial system. Remember, the future of finance is being written now, and AI is undoubtedly one of the primary authors.